Call us: 01865 842 266

Email us: [email protected]

Oxford Accountants Helping Local Businesses Thrive

Helpful, personal accounting for local businesses: Simple guidance, consistent assistance, or a dependable set of hands to keep your business moving.

Brookwood Accountancy takes the stress out of financial management for small businesses in

and around Oxford. As local specialists based in Kidlington, we provide straightforward advice and sound commercial decisions, alongside dependable support whenever you need it. Our team is always available for a direct conversation; there are no automated systems or long waiting times, just expert support when it matters most.

Accountants Who Understand Oxfordshire Businesses

Brookwood Accountancy is a contemporary practice focused on clear guidance, reliable assistance, and authentic professional connections. We avoid complex technicalities and ensure you speak to the right person immediately, without being passed between departments. We make everything transparent, maintain regular contact, and ensure you feel in control of your finances, whether you are a start-up or an established enterprise.

Based in Kidlington, we support sole traders, partnerships, and limited companies across Oxfordshire. We provide proactive accountancy advice tailored to help your business grow. Some clients seek a dependable team to ensure that the fundamentals are managed correctly. Other clients seek a partner to anticipate future challenges, devise a strategic plan, and bring order to the decision-making process.

In either case, we look at things over the long term. We do more than just hit filing deadlines; we help you use your financial data to improve operations and make informed business decisions. If you need Oxford accountants who combine practical assistance with local insight, we would love to help.

Our Accountancy Services

We have tailored all our accountancy offerings to give you the correct level of support immediately, with the flexibility to adapt as your business grows.

Bookkeeping

Daily bookkeeping to ensure your records are accurate, organised, and VAT-ready.

Tax & Compliance

Daily bookkeeping to ensure your records are accurate, organised, and VAT-ready.

Payroll

Daily bookkeeping to ensure your records are accurate, organised, and VAT-ready.

Specialist Tax

Daily bookkeeping to ensure your records are accurate, organised, and VAT-ready.

Financial Forecasting

Daily bookkeeping to ensure your records are accurate, organised, and VAT-ready.

Company Secretarial

Daily bookkeeping to ensure your records are accurate, organised, and VAT-ready.

Virtual Finance Director

Daily bookkeeping to ensure your records are accurate, organised, and VAT-ready.

HMRC Enquiries

Daily bookkeeping to ensure your records are accurate, organised, and VAT-ready.

TESTIMONIALS

What Our Oxfordshire Clients Say

Our clients stay with us because they value our continuity, reliability, and the peace of mind that comes from having an expert on their side at key times.

"The Brookwood team have been our accountants for our three companies since 2006. We are delighted with their services and feel valued as a loyal customer."

- M Davis

"As a client for more than 20 years, I have always found Brookwood highly efficient, quick to respond and very helpful, offering advice and excellent support whenever its been required."

- M Potts

"Everyone is extremely helpful from small details to important tasks. Thank you for excellent service over 10 years."

- A Waterhouse

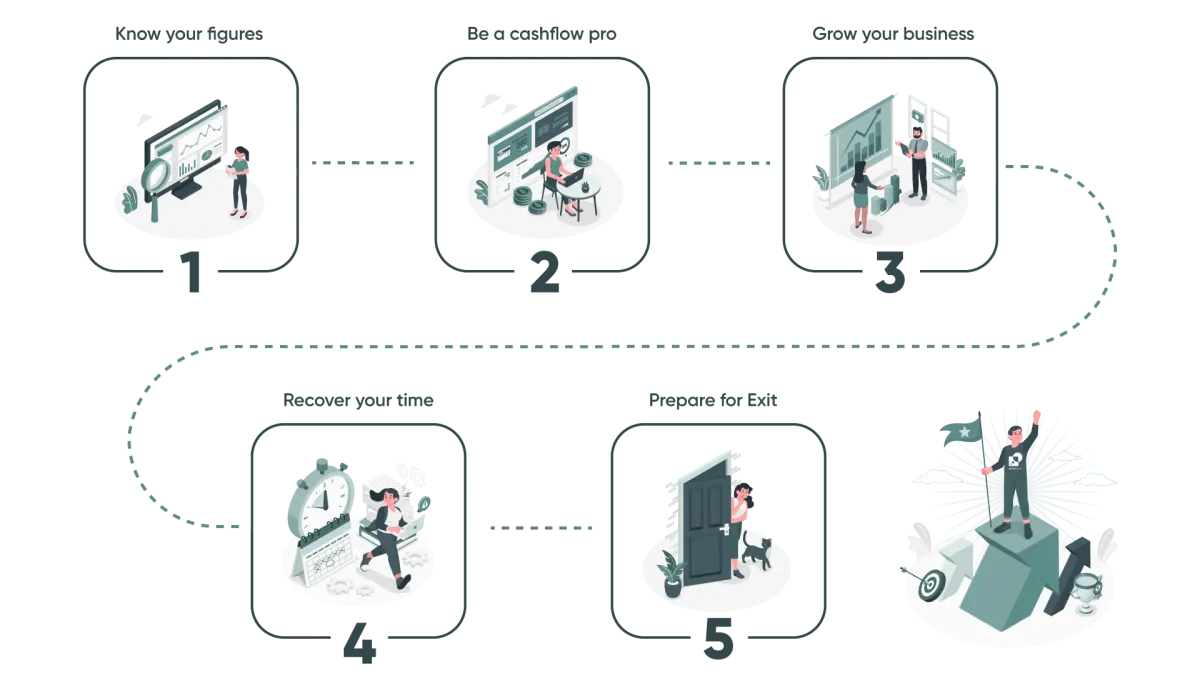

What Level of Support Do You Need?

No two businesses look the same, and the level of support you need will change over time. At Brookwood, we tailor our services around where you are now and where you want to get to.

1. Just the Essentials

This option suits business owners who want the basics handled properly. We take care of accounts, tax and statutory submissions so you stay compliant, without unnecessary complexity or add-ons.

2. Accounts with Support and Guidance

Designed for businesses planning ahead. Alongside compliance, we provide regular reviews, business valuations, and competitor insights to support growth, succession, or future sale planning.

3. Fully Managed, Next Level

Leave the day-to-day bookkeeping and accounts to us. We manage your finance function, systems and reporting, supported by advisory input and access to coaching and mentoring when needed.

4. Cloud Wealth Club

For cloud accounting clients who want ongoing support and accountability. Access practical tools, regular updates, and peer support via structured sessions focused on performance.

5. Business Development, Business Coaching & Mentoring

Focused on accountability and direction. This level supports business owners who want structured guidance, regular check-ins and mentoring to help avoid common pitfalls and stay aligned with their goals.

6. Virtual Finance Director

Senior-level financial support tailored to your business, without the commitment of a full-time FD. From day-to-day decision support to board meetings, growth planning or acquisitions, you gain experienced financial leadership as you need it.

Why Oxford Businesses Choose Brookwood

Brookwood has more than two decades of backing businesses within Oxford.

Local knowledge supporting Oxfordshire businesses for over 30 years.

Personal, approachable experts committed to long-term relationships.

Consistently clear advice that allows you to make decisions with confidence.

Comprehensive support covering compliance, growth planning, and mentoring.

Proactive tax planning designed to enhance your overall profitability.

Contact us today to find out how we can support your business.

Meet the Brookwood Team

We are an Oxfordshire-based team of Accountants, Bookkeepers and Virtual Finance Directors. We pride ourselves on our approachable nature and our passion for working with local business owners. We strive to keep our services transparent, professional, and relevant.

Roger Farrell

CIMA Adv Dip MA, AAS, BSc

Director

Sophie Burborough ACCA

Accountant

Katy Ward ACCA

Accountant

Amy Johnson

Digital Comms and Branding

Rita Behal

Practice Manager & Accounts Assistant

Tracey Seymour

Bookkeeper & Cloud Accounting Support

Kay Honour

Bookkeeper & Payroll Administrator

Alanna Thomas BSc

Trainee Accountant

Megan Sero-Jones

Social Media and Marketing Assistant

Alena Čieškovā

VFD Support Manager

Adam Norman

Trainee Administration Assistant

Kiran Dhokia

Junior Accountant

Gus

Company Mascot

Need help filing a self-assessment tax return in Oxford?

We are a straight-talking team and would be happy to discuss your requirements. We prefer real conversations over hiding behind emails, and we are proudly based in your local community.

Pop in to see us at 19 Banbury Road, The Old Post Office, Kidlington, Oxford OX5 1AQ or give us a call on 01865 842 266.

Get in Touch

If you get in touch today, we can get started book a Free Half Hour consult

How Brookwood Works

Business News & Oxford Insights

Clear news, updates, and practical tips on tax, HMRC compliance, and managing your business efficiently.

Loading latest insights...

Sign up to keep up to date

© 2024 Brookwood Accountancy Limited is a company registered in England and Wales Registration Number: 03734519

Registered Office: The Old Post Office, 19 Banbury Road, Kidlington, Oxford OX51AQ

Call us: 01865 842 266