Call us: 01865 842 266

Email us: [email protected]

We Turn Numbers Into Knowledge

Mission: To provide our clients with superior accounting and advisory services to improve their personal and commercial quality of life, assisting with achieving their goals and to provide employees and owners with meaningful careers that include flexibility and opportunity for success.

Turning Numbers Into Knowledge

We are here to help you make the best decisions about your company. Our clients are people, and we never forget the person behind the business.

Our focus is your businesses long term success. Everything we do is towards helping you succeed in business.

Compliance Accounts

Company Tax Returns

Management Accounts

Virtual Finance Director

Tax Planning

Capital Gains

Inheritance Tax

TESTIMONIALS

Reasons to use Brookwood

Wow, it's scary how many years we have been working with some of our clients. We hope we can help you and your business for years to come. We are here to work with you for the duration, whatever your business aspirations.

"The Brookwood team have been our accountants for our three companies since 2006. We are delighted with their services and feel valued as a loyal customer."

- M Davis

"As a client for more than 20 years, I have always found Brookwood highly efficient, quick to respond and very helpful, offering advice and excellent support whenever its been required."

- M Potts

"Everyone is extremely helpful from small details to important tasks. Thank you for excellent service over 10 years."

- A Waterhouse

What do you want to achieve?

Every business owner and every business is different so they need tailored services to fit their needs. First we start with what level of accounts support you need. Then we look at what further development the business needs. Is your business getting you to the place you wanted to arrive at..?

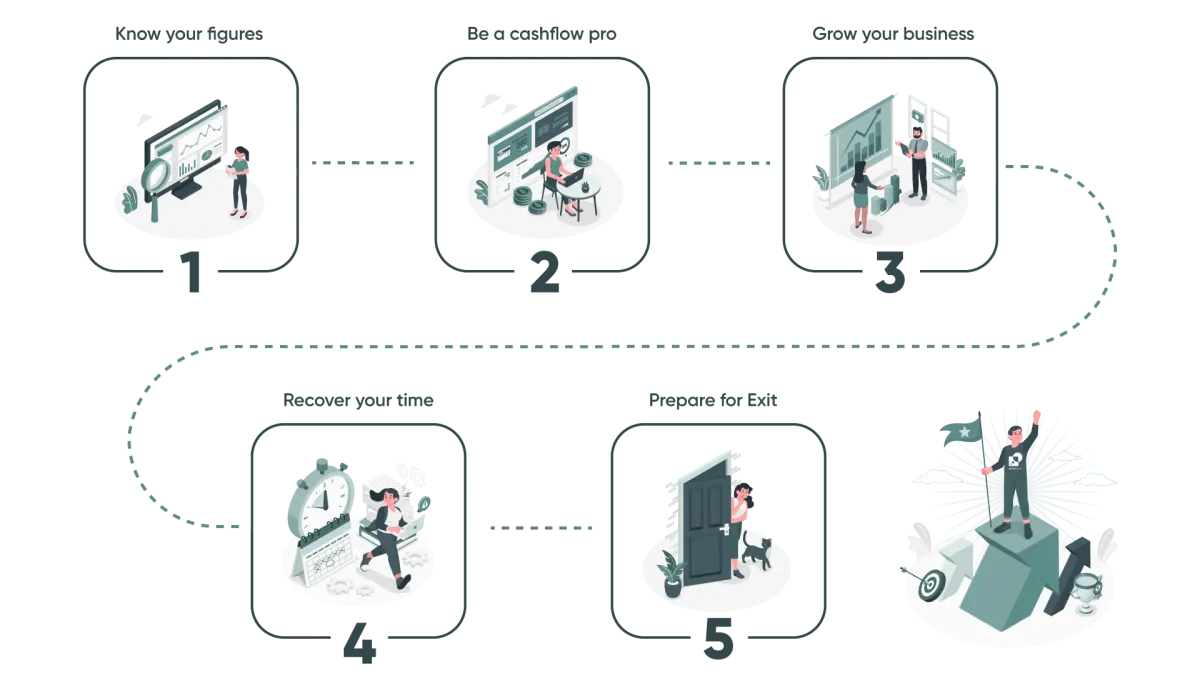

1. Just the Essentials

You only want help to do what's needed for HMRC and Companies House. Accounts, Tax and Self Assessment. You are not trying to increase the business or profitability. Just the basics with no frills, bells or whistles.

2. Accounts with Support and Guidance

You have a business, and are working on plans for growth, sale or succession planning. We take the compliance a step further with business valuations, competitor analysis and regular reviews. Personal and family wealth including tax planning.

3. Fully Managed, Next Level

You will get on with going forward and leave the Bookkeeping and Accounts to the experts. Backoffice, Tech, and Support including Advisory.Membership to Coaching & Mentoring included.

4. Cloud Wealth Club

Cloud Wealth Club As a cloud accounting client, we are here to support you. Join the facebook group for regular updates and fellow client support. Attend real business growth club meetings designed to hold you and your team accountable.

5. Business Development, Business Coaching & Mentoring

Its all about Accountability, to yourself, your business, your team and your goals. Avoid pitfalls, get support and guidance on regular group cohort calls.

6. Virtual Finance Director

A full FD role can be developed just for you company.

Save the cost of a full FD salary.

From Day to Day, Board Meetings, Sale and Acquisitions Challenges you have a professional on board.

All The Tools You Need To Build A Successful Business

Free Half Hour Consultation Wherever you are in your business life...

From start-up to sale and everything in between, we can help take the worry out of the decisions. As a trusted advisor we can assist your business and you with any challenges.

With qualified: Accountants, Technicians, Bookkeepers and Business Advisors, we offer much more then compliance.

From companies supporting 1000 year old colleges, to environmentally focussed start ups. We are here to guide and assist throughout.

It may be a new problem or idea to you, but chances are we have had experience with it or something similar.

We provide support and technical advice throughout the year.

We have packages designed to suit all companies.

Growth or Retirement, Sale of the business or profit extraction - we can help you make the most of what you want out of your business.

Meet the Brookwood family

Consider us family. We are gonna stick by your side and help your business thrive!

Roger Farrell

CIMA Adv Dip MA, AAS, BSc

Director

Sophie Burborough ACCA

Accountant

Katy Ward ACCA

Accountant

Amy Johnson

Digital Comms and Branding

Rita Behal

Practice Manager & Accounts Assistant

Tracey Seymour

Bookkeeper & Cloud Accounting Support

Kay Honour

Bookkeeper & Payroll Administrator

Alanna Thomas BSc

Trainee Accountant

Megan Sero-Jones

Social Media and Marketing Assistant

Alena Čieškovā

VFD Support Manager

Deyvis Limonta

Administrator & Bookkeeper

Kiran Dhokia

Junior Accountant

Adam Norman

Trainee Administration Assistant

Gus

Company Mascot

Get in Touch

If you get in touch today, we can get started book a Free Half Hour consult

How Brookwood Works

News from our Blog

Keep up to date with industry information which might help you in your business.

Risks of thinking small

The Risks of Thinking Small as a Small Business Owner

Thinking small as a business owner can stifle growth, limit innovation, and increase vulnerability to market shifts. Experts warn that underestimating your potential can be more dangerous than overreaching.

Here’s a breakdown of the key risks associated with “thinking small,” backed by insights from business lecturers, professional speakers, and recent research.

1. Missed Growth Opportunities

Small thinking often leads to conservative decision-making, which can prevent businesses from pursuing scalable opportunities like new markets, product lines, or strategic partnerships. Forbes Business Council members note that failing to take calculated risks—such as expanding services or investing in marketing—can result in stagnation and missed revenue.

2. Mental Framing Limits Strategic Vision

Business lecturers emphasize that mindset shapes strategy. When owners view their business as “just a small operation,” they often avoid long-term planning, tech adoption, or branding efforts that could elevate their market position. This mindset can also lead to underinvestment in leadership development and systems that support growth.

3. Overreliance on Key Individuals

According to ISOwise, key person dependency is a hidden risk in small businesses. Thinking small often means not building redundancy or scalable processes, leaving operations vulnerable if one person exits or burns out.

4. Poor Risk Management

SumUp’s research shows that small businesses frequently overlook strategic and operational risks, especially when they assume their size protects them from major disruptions. Without proactive planning, even minor setbacks—like supply chain issues or regulatory changes—can have outsized impacts.

5. Misguided Imitation of Big Corporations

Cansulta warns that thinking big doesn’t mean copying big business. Small firms that mimic Fortune 500 strategies (e.g., complex hierarchies or expensive tech stacks) often fail because they lack the resources and agility to execute them effectively. Instead, small businesses should think ambitiously but act with lean, tailored strategies.

6. Resistance to Innovation

Small-thinking owners may avoid digital tools, automation, or advisory services, fearing complexity or cost. This resistance can lead to competitive disadvantage, especially as customer expectations evolve.

What Experts Recommend Instead

Adopt a growth mindset: Think in terms of impact, not size.

Invest in scalable systems: Even simple CRM or workflow tools can future-proof operations.

Build redundancy: Cross-train staff and document processes.

Set ambitious but realistic goals: Use advisory support to map out strategic growth.

Sources:

: Forbes Business Council – “The Danger of Thinking Small”

: Harvard Business Review – “Mindset and Strategic Planning in SMEs”

: ISOwise – “Key Person Risk in Small Businesses”

: SumUp – “Small Business Risk Management Report”

: Cansulta – “Why Small Businesses Shouldn’t Copy Big Corporations”

: Entrepreneur – “How Small Thinking Blocks Innovation”

Sign up to keep up to date

© 2024 Brookwood Accountancy Limited is a company registered in England and Wales Registration Number: 03734519

Registered Office: The Old Post Office, 19 Banbury Road, Kidlington, Oxford OX51AQ

Call us: 01865 842 266